A report from the Environment and Sustainability Committee

By: IAN LOUGHRAN, P.ENG.

Opinions expressed do not necessarily reflect the views or policies of APEGS.

With the growth in the solar industry in Alberta and Saskatchewan, we may be asking ourselves, “Is solar photovoltaic (PV) economic?”. When contemplating how to respond to this, one must ask, “What defines economic?”

There is an economic difference between rooftop or small-scale solar PV (typically in the 2-10 kW range), larger ground mount systems (10-100 kW) and utility-scale solar farms (5 MW plus).

Currently, through SaskPower’s net metering program, any resident or business can install solar PV on their building up to 100 kW. The average house has somewhere between 2-6 kW of available roof space. In Saskatchewan, we are currently seeing installed costs of solar PV systems ranging from as low as $3 per watt to around $4 per watt. We have seen numbers drop rapidly in solar PV since 2009, from $9 to $12 per watt to the current rates. This is a significant change. And while the curve is flattening out and the year-over-year decreases are far less now, the current installed costs are surprisingly economic.

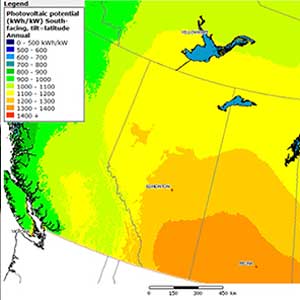

If we use southern Saskatchewan and look at Natural Resources Canada’s solar insolation map, we see promising energy levels available from the sun.

If we use Regina as an example, at an annual production of 1300 kWh/kW installed and use the average of 3.0 kW on a house with southern exposure (no building or tree shading), we have 3900 kWh of energy production per year.

If we assume that the residential retail price per kWh from SaskPower is $0.15/kWh, we have $585 per year in energy savings. If we assume the average solar PV installed costs are $3.5/watt, for a 3kW system we have an installed cost of $10,500.

That may not sound like a good investment, as some would just divide the $585 into $10,500 and conclude it is an 18-year simple payback. However, we know that power rates are going up about 6 per cent per year. So with this math in hand, we then get a payback of approximately 12 or 13 years.

Some may still argue that this is not a good investment but consider levelized cost or lifetime energy costs.

The levelized cost is the total capital and operating costs over the useful life of the power generation asset, divided by its total energy production over the system life. There are financing charges, time value of money, inflation and other items in this calculation but in its simplest form we can use the example above to show proof of concept.

If we assume that the useful life of a solar system is 25 years and we use a $0.005/kWh operations and maintenance fee and a 0.5 per cent system degradation per year, the 3.0 kW system described above will have a levelized cost of about $0.12/kWh and will stay the same over its lifespan. This is already $0.03/kWh lower than the residential retail rates from SaskPower. SaskPower also currently offers a net metering rebate of 20 per cent of the capital investment for a solar system, so with this rebate the levelized cost of this solar PV system would be $0.10kWh.

One can draw one’s own conclusions based on this but it is clear that solar orientation of buildings, taking advantage of solar PV and passive solar (enabling the sun’s free heat to be used in a building), is going to be common in the coming decade. Whether to save money or to offer a small buffer from a pending carbon tax, investment in solar PV is going to continue to increase in value and opportunity.